Our clients have obligations that extend beyond 70 years. As their investment manager, we are responsible for ensuring that they can meet their long-term funding needs to pay pensions and finance the insurance and benefit funds within British Columbia. Our commitment to our clients underpins everything we do. BCI invests in quality assets and stable companies with the potential to appreciate in value and provide reliable cash flows in the years to come. Our outlook, strategies, and approach are driven by longer term considerations.

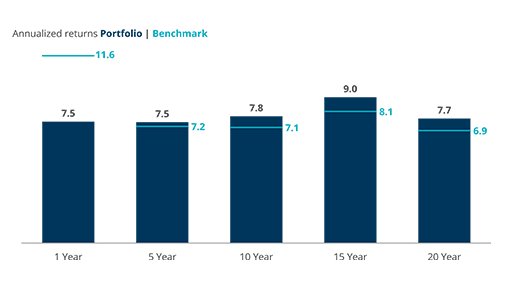

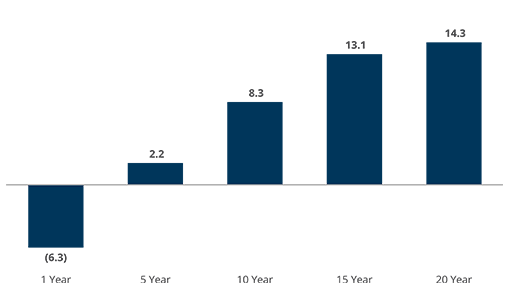

We report the annualized pension returns and cumulative value added on an annual basis for the fiscal year-end March 31. This reflects the investments of BCI’s six largest pension clients.

Returns for the periods ended March 31, 2024

For the periods ended March 31, 2024

BCI is invested in public and private equity; infrastructure and renewable resources; fixed income and private debt; as well as real estate equity and real estate debt through our independently operated platform company QuadReal Property Group. Investments are diversified by region and investment style, and guided by our clients’ tolerance for risk.

Like a mutual fund, a pooled fund combines our clients’ contributions and invests in securities and other assets. We manage a range of portfolios with investment strategies that cover all major asset classes. Our investment products are designed with a medium to long-term investment horizon in mind, and we favour investments that can be held for long periods.